personalising the xperience for

96 million members

you may not know what your customers want.but m’Loyal does.

Comprehensive Omni-Channel Loyalty Analytics & Marketing Platform

Host your loyalty program on Paytm app and stay consumer-ready with data-driven artificial intelligence-powered technology.

Our Customer Acquisition Cloud (CAC)™ solutions enable brands to leverage channels across social, mobile, the web, offline and traditional media to acquire, track and convert potential customers into real shoppers.

Paytm m’loyal helps you understand:

Paytm m’loyal’s CRM interface helps you:

Paytm m’loyal can be easily integrated with your POS systems, web, social, mobile, market places & offline channels to stitch each of your customer touchpoints. It comes with built-in widgets, utilities and software components to capture vital customer details.

From coming up with innovative program names, logos and tag lines to online advertisements, social media proliferation, and appropriate use of QR codes & digital media, we drive higher visibility and build winning loyalty programs

Customer Engagement Cloud (CEC)™ is an ROI tracker and a real-time one-2-one campaign management solution.

Inbuilt Campaign management tool allows you to cluster your data with as many Permutations / combinations possible. Cluster based ROI is available in real time to plan the next campaigns based on cluster performance.

Precision Mktg Framework (PMF)™ help brands understand consumer behavior, product preference, quantitative and subjective factors to define the right communication for all types of consumers.

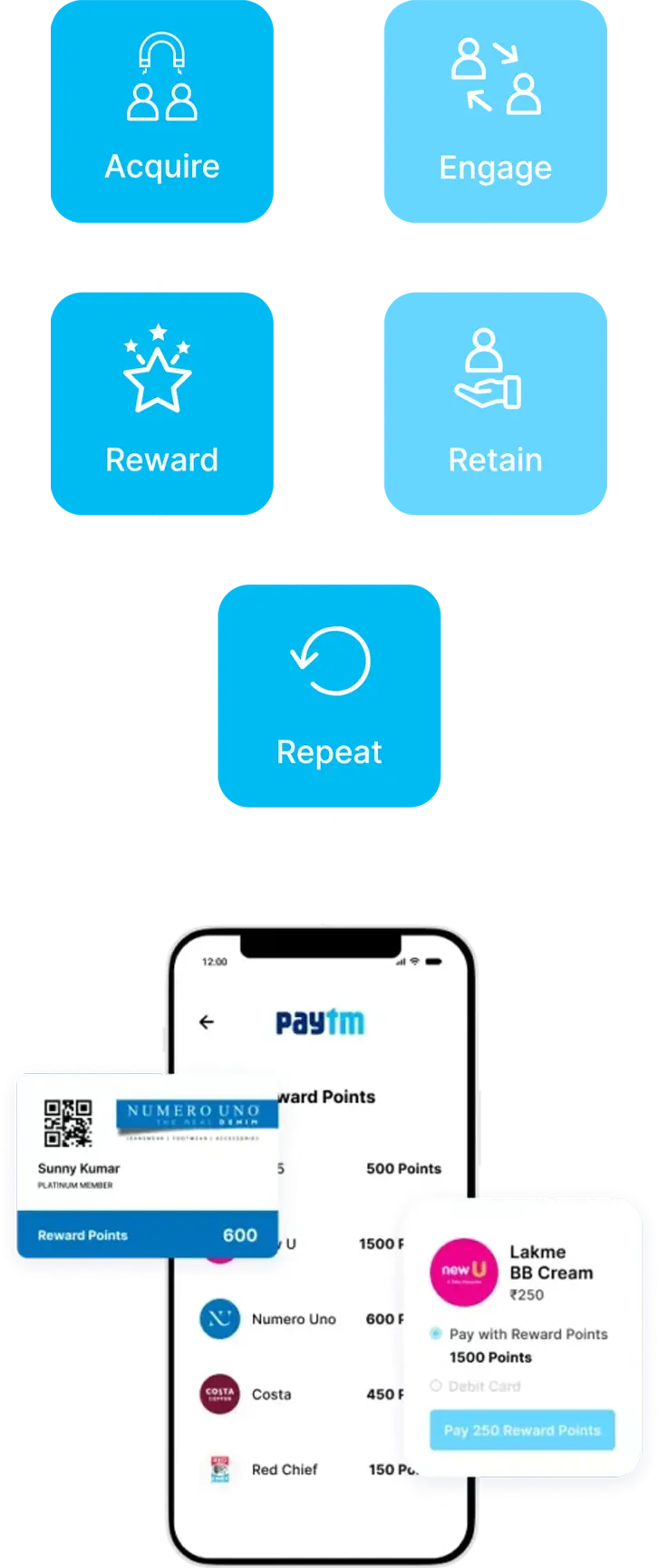

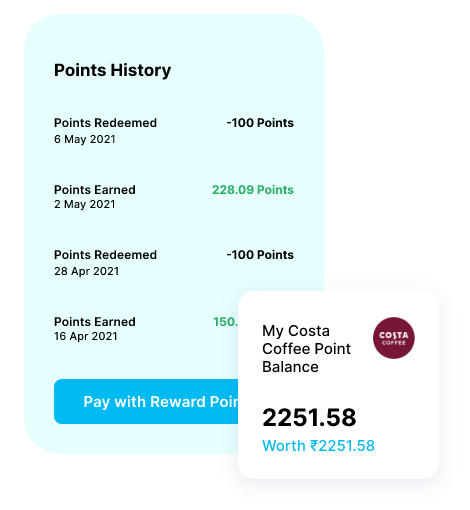

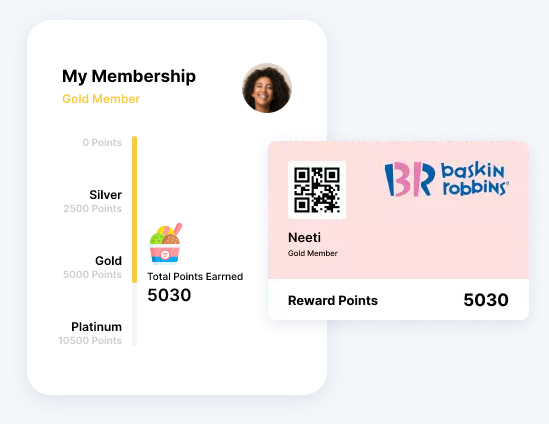

Personalised customer loyalty mobile apps allow customers to view their transaction history, points, messages, notifications, brand ads as well as access brand social channels and eligible coupons & rewards.

A comprehensive member portal that allows members to check their loyalty points, messages, coupons and rewards. It comes with an in-built shopping cart, rewards store and mobile couponing engine.

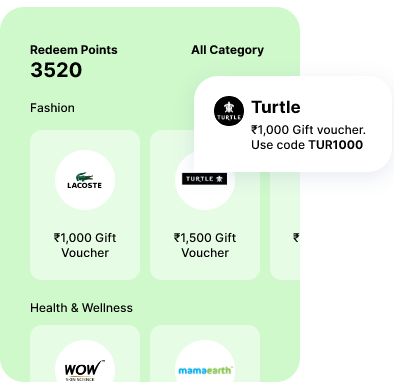

Our Customer Reward Cloud (CRC) enable brands to choose from 250+ different kinds of schemes and loyalty logics to offer their customers. It also helps brands gain valuable insights into consumer buying behavior and impact the lifestyle

“LBI” is well-thought loyalty rules & intelligent schemes engine ensures your loyalty & engagement efforts move in the same direction. It helps you:

DAM is a real-time data analytics & clustering tool that offers:

Available across all smartphone devices, online and on social media, Rewards Store™ offers an online/mobile infrastructure to help brands create a rewards ecosystem. Brands can simply pull in vouchers/offers from complementary brand partners or their own ecosystem. They can also create targeted rewards for different customer clusters. Reward with Points, Cash-backs or gift vouchers

The most comprehensive Loyalty & Marketing Platform you can bank on!

Open your brand to the limitless customer engagement

possibilities with Paytm m’loyal

100 Million+ Loyalty members, 300+ Brands Engaged & ₹161 Billion+ Loyalty Sales

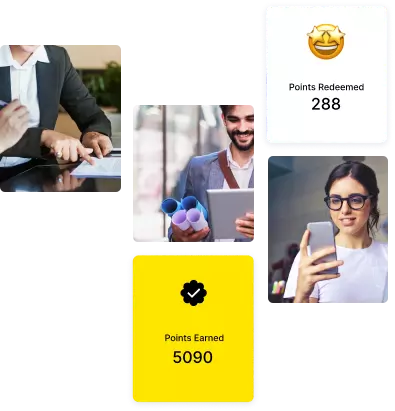

Drive end-to-end customer engagement from one powerful dashboard.

Launch your Loyalty Program on the Paytm App and increase reach, enrolments, redemptions and a host of benefits to your customers & influencers

Supports quick & easy integration with a wide range of billing systems.

Let customers use their mobile phones to earn & burn points without using cash with the Paytm App.

Gain valuable insights for faster decision-making & reduce operating costs.

![]()

![]()

![]()